When it comes to auto insurance in Michigan, navigating the complex landscape of coverage options and cost factors can pose a challenge. This detailed guide aims to unravel the intricacies of auto insurance in the Great Lakes State. It explores various coverage types and sheds light on unique considerations that impact insurance costs.

What is Auto Insurance in Michigan?

Auto insurance in Michigan transcends being a mere legal requirement; it is a vital financial safety net that shields drivers from unforeseen expenses resulting from accidents, theft, or other covered incidents. Beyond its status as a mandatory obligation, auto insurance emerges as a crucial tool for ensuring financial security on the roads of Michigan.

Auto insurance serves as a vital safeguard, offering protection and financial assistance during critical moments for drivers. It plays a crucial role in minimizing the economic impact of unforeseen circumstances, granting drivers peace of mind as they navigate the roads of the Great Lakes State.

Michigan’s auto insurance approach is unique. It operates under a no-fault system, which adds complexity to the coverage. In this system, regardless of fault, each party involved in an accident is responsible for their damages. This approach not only streamlines the claims process but also ensures prompt support for individuals.

Understanding auto insurance in Michigan entails more than just meeting the state’s minimum coverage requirements. It also involves grasping the intricacies of the no-fault system. Drivers are encouraged to explore additional coverage options that cater to their specific needs, providing an extra layer of protection against unforeseen circumstances.

Comprehending auto insurance in Michigan involves not just meeting the minimum coverage requirements mandated by the state but also understanding the nuances of the no-fault system. Drivers are encouraged to explore additional coverage options that align with their individual needs, providing an extra layer of protection against the unexpected.

Auto insurance in Michigan is a multifaceted tool that extends beyond legal compliance. It is a shield against financial uncertainties, a support system during challenging times, and a key element in ensuring a sense of security for drivers on Michigan’s roads.

Understanding Michigan’s Auto Insurance Landscape

Navigating Michigan’s roads entails the responsibility of comprehending its distinctive auto insurance landscape. This narrative will explore the complexities of Michigan’s auto insurance system, shedding light on its unique features and providing valuable insights for drivers.

No-Fault Auto Insurance System in Michigan

Michigan’s auto insurance landscape stands out for its unique no-fault system. This system holds each party accountable for their damages in an accident, regardless of fault. To ensure comprehensive coverage, the system includes Personal Injury Protection (PIP), which takes care of medical expenses for all individuals involved, irrespective of who is at fault.

Minimum Coverage Requirements

To navigate Michigan’s auto insurance landscape effectively, it’s crucial to understand the state’s minimum coverage requirements. These include specified liability limits and mandatory Personal Injury Protection (PIP) coverage. Adhering to these requirements is essential for drivers to comply with the state’s regulations and ensure they have adequate coverage.

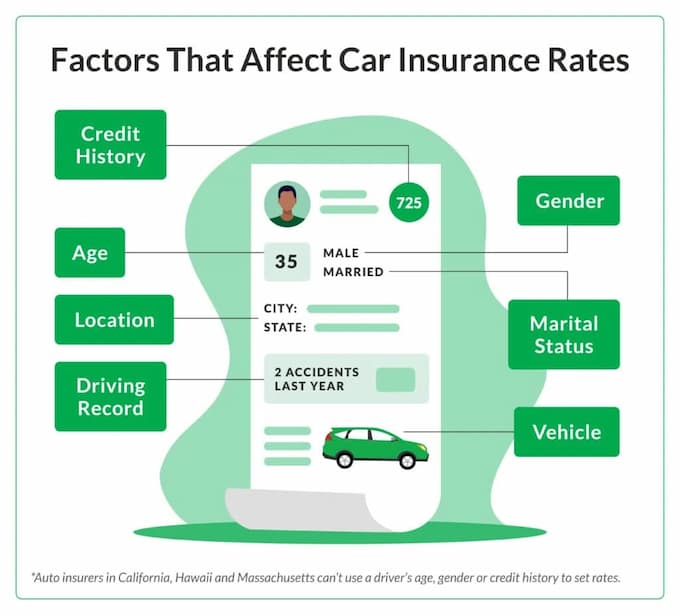

Factors Influencing Auto Insurance Costs in Michigan

Michigan’s auto insurance costs are shaped by distinctive factors that contribute to the state’s unique insurance landscape. Understanding these factors is essential for drivers seeking to navigate the complexities of Michigan’s auto insurance environment.

Unique Cost Factors in Michigan

Michigan’s auto insurance costs are influenced by several unique factors. The no-fault system, which streamlines the claims process, also contributes to the state’s distinct insurance landscape. Additionally, the high cost of medical services and the prevalence of uninsured drivers in the state impact overall insurance costs.

- The No-Fault System: Michigan’s adoption of the no-fault system is a significant factor influencing insurance costs. This system streamlines the claims process but also contributes to the state’s distinct insurance landscape.

- High Cost of Medical Services: The high cost of medical services in Michigan plays a role in elevated insurance costs. The no-fault system, which covers medical expenses, can contribute to increased premiums.

- Prevalence of Uninsured Drivers: Michigan faces challenges related to uninsured drivers, impacting overall insurance costs. Uninsured drivers can increase the financial burden on insured drivers.

Strategies to Lower Auto Insurance Premiums

Despite the unique challenges presented by Michigan’s auto insurance landscape, drivers can adopt effective strategies to manage and potentially lower their premiums:

- Maintain a Clean Driving Record: Safe driving habits contribute to lower insurance premiums. Avoiding accidents and traffic violations can lead to reduced insurance costs.

- Bundle Insurance Policies: Bundling auto insurance with other policies, such as home or renters insurance, often results in discounts. This approach provides a cost-effective way to manage overall insurance expenses.

- Explore Available Discounts: Insurance providers in Michigan offer various discounts, including safe driver discounts, multi-car discounts, and loyalty discounts. Exploring these options can lead to significant savings.

Navigating Michigan’s auto insurance landscape involves understanding the intricacies of the no-fault system, complying with minimum coverage requirements, and addressing unique cost factors. By implementing effective strategies to lower premiums, Michigan drivers can proactively manage their auto insurance costs and make informed decisions.

Navigating the Claims Process

This section offers a comprehensive guide on navigating the auto insurance claims process in Michigan. It is crucial to be well-informed about the necessary steps to take in case of an unfortunate accident as it can significantly impact the final outcome.

- Ensure Safety First: In the aftermath of an accident, prioritize safety. Check for injuries and move to a safe location if possible. Activate hazard lights and, if necessary, call for emergency assistance.

- Exchange Information: In the event of an accident, it is important to exchange information with all parties involved. This includes obtaining their names, phone numbers, addresses, insurance policy details, and vehicle information. By exchanging this vital contact and insurance data, you can ensure a smooth resolution to the situation.

- Document the Scene: Capture photographs of the accident scene, ensuring to include detailed shots of vehicle damage, license plates, and the surrounding area. This comprehensive documentation holds utmost importance as vital evidence throughout the entire claims process.

- File a Police Report: In Michigan, it’s advisable to file a police report, especially if there are injuries or significant property damage. The police report provides an official record of the incident.

- Contact Your Insurance Provider: Promptly notify your insurance provider about the accident. Provide them with accurate and detailed information. Follow their guidance on the next steps in the claims process.

- Medical Treatment: If you or others involved in the accident require medical attention, seek treatment promptly. Keep detailed records of medical expenses and provide them to your insurance company.

- Cooperate with Adjusters: Insurance adjusters will assess the damage and determine liability. Cooperate fully with the adjusters, providing necessary documentation and information.

- Understand Your Coverage: Familiarize yourself with your auto insurance coverage. Different coverages may apply to various aspects of the accident, such as property damage, bodily injury, or medical expenses.

- Resolution and Settlement: Work with your insurance company to reach a resolution. This may involve negotiating a settlement for repairs, medical bills, or other related expenses.

- Seek Legal Advice if Necessary: If disputes arise or if you face challenges in the claims process, consider seeking legal advice. An attorney experienced in auto insurance claims can provide valuable assistance.

Navigating the auto insurance claims process in Michigan requires a systematic approach, from ensuring immediate safety to understanding coverage details and cooperating with insurance professionals. By following these steps, individuals can navigate the complexities of the claims process and work towards a satisfactory resolution.

In conclusion, having a robust understanding of auto insurance in Michigan is pivotal for every driver. From comprehending the no-fault system to managing costs effectively, this guide aims to empower Michigan drivers to make informed decisions about their auto insurance coverage.